By Bob Cunneen, Senior Economist and Portfolio Specialist, NAB Asset Management

In a surprise outcome, Britain has decided to LEAVE the European Union. While the reaction and full implications of the referendum will continue to evolve, Bob Cunneen answers some of the initial questions investors are asking right now.

These comments were made at 5.00pm Australian Eastern Standard Time.

1. At this early stage, what will be the impact for Australian investors?

Expect market volatility to be high over the coming days, weeks and possibly months. The decision to leave has triggered a new uncertain environment and markets will need to understand the impact this vote will have on Britain, and the implications for the European Union (EU) more broadly. This will take time and hence market volatility will probably be high.

The severe share and currency market reactions today suggest that joining the selling exodus may be a little too late. The history of such events suggests that they can provide buying opportunities when others are panicking. However, the outlook is so uncertain that we would suggest remaining cautious for the present until the picture is clearer.

Investors should be reassured that MLC portfolios have maintained a relatively defensive stance in the lead up to this event. We will continue to reassess these strategies as more information comes to light.

2. Why is Britain’s decision to leave the EU so surprising to financial markets?

Financial markets had favoured Britain would remain in the EU. While there had been considerable swings in the polls in the final weeks of the campaign, on the eve of the vote, the average poll measure suggested a narrow victory to the “remain” side. The Financial Times ‘poll of polls’ on 22 June showed a narrow poll lead to “remain” but with an “undecided” component of 8%.

Even the betting markets favoured Britain remaining, with bookmakers seeing a 75% probability of Britain remaining.

3. What’s the likely impact on Britain’s economy?

There are a wide range of views on this. The consensus generally suggests Britain’s economic growth will struggle, because it’s significantly integrated into the European economy.

Britain relies on Europe for 48% of Foreign Direct Investment and nearly 45% of exports. So the decision to exit could have a dramatic impact on Britain’s prosperity.

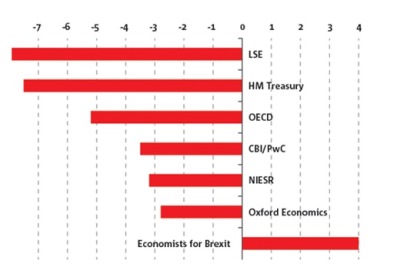

The average estimate of seven long-term forecasters is that the exit will lower Britain’s economic growth by a net of -3.8 % over the next 15 years, to 2030. See chart 1.

Chart 1: Estimates of long term effect of Brexit on national income

% change in GDP compared with remaining in the EU, assuming trade based on WTO rules

Source: Forecasters, Financial Times, 21 June 2016.

The economic debate is whether this loss to Britain’s GDP prospects occurs in the short term, with Britain immediately slipping into recession, or over a long period. The Bank of England and UK Treasury have warned about the possibility of a recession.

Should Britain suffer a financial crisis with asset prices falling sharply (for example, if Britain’s FTSE share market falls by -15 %) and credit becomes difficult to access for corporations and consumers, then Britain may slip into recession.

However there are two key reasons why a British recession is a possibility rather than the most likely outcome:

-

Both the British and European Central Banks are likely to pledge liquidity supports for European financial institutions, so a major financial crisis due to a credit crunch appears a low chance.

-

Notably Britain’s decision to exit the European Union is a process that can will take up to 2 years under the Treaty of Lisbon requirements. So the immediate negative impact is more likely to be seen through financial market volatility rather than Britain’s economy suddenly sliding into the Atlantic Ocean.

If the economic pain of a -4% loss to GDP is spread over the next 15 years , this would imply that Britain’s long term economic growth would be around -0.25% lower per year. Given Britain’s economic growth is travelling at a 2% annual pace, this is a more modest but manageable negative impact.

So Britain appears more likely to experience slower growth but not an immediate recession, given the negative impact should be spread over a longer period.

4. What’s the likely impact on the Global economy?

Britain accounts for about 2.7 % of Global GDP and is much smaller than the US and China (around 16% each).

If Britain’s economic activity fell by -4% in the worst case scenario, this would take only -0.1% off global economic growth. Given that global growth is currently running at a +3% annual pace, this does not automatically lead to a global recession or a global financial crisis, as seen in 2008.

The more immediate risks to global economic prospects actually come from China’s economic slowdown, weakness in emerging markets such as Brazil and Russia, and the prospect of the US Federal Reserve raising interest rates.

5. What does this outcome mean for European and British investors in the short term?

This decision highlights political risks and is likely to generate considerable volatility in European financial markets. Britain’s financial markets are likely to be key focus for turbulence:

-

Exchange rate: Britain’s exchange rate is vulnerable given they’re running a very large Current Account deficit above -7% GDP which relies on capital inflows.

-

Higher risk premiums: Britain’s likely to see higher risk premiums for asset prices. Britain’s share market would be sensitive to the potential higher cost for banks wholesale funding and for corporate credit.

-

Long-term involvement in Europe: there’s likely to be considerable angst and doubt about Britain’s long-term involvement in Europe.

-

Uncertainty in Scotland: the economic case for staying in the EU in terms of economic and security benefits was more persuasive in Scotland than in Slough. So there’s the distinct possibility of another Scotland referendum about staying in the United Kingdom.

-

Britain’s exit is a major concern for Europe: The European project of economic integration and monetary union has been set back. Countries may decide to have their own referendum on EU membership or even being a member of the Euro area. Key countries such as Italy and Spain, who have the euro as their currency, with the European Central Bank setting interest rates, may decide to seek a referendum on their involvement.

-

European recovery set back: A further polarisation of European politics makes the task of Europe’s economic recovery more difficult. There will be considerable pressure on the European Central Bank to do “whatever it takes” to keep the euro intact.

6. What next? A possible trajectory of events

-

Likely instability within the UK’s Conservative Party. The Prime Minister David Cameron may resign within days or weeks. Regardless, he’s unlikely to last as Prime Minister until the 2020 General Election.

-

Potential for Scotland to demand a new referendum given their strong support for to remain.

-

Likely emergency meeting of the EU to discuss the implications, not just for British / EU relations but also other countries with Europe. The EU will be looking for a strong commitment to unity of the remaining members.

-

Negotiations will commence in Brussels in the next couple of months on the terms of exit and any possible subsequent treaties with the EU.

-

UK commences the review to abolish or rescind laws and agreements relating to current relations with the EU (especially where EU laws take precedence over UK laws).

-

Within 2 years of triggering the exit process, the UK would likely no longer be bound by existing EU Treaties.

Source: NAB Asset Management 24 June 2016

Important information

This communication is provided by MLC Investments Limited (ABN 30 002 641 661, AFSL 230705) (“MLC”), a member of the National Australia Bank Limited (ABN 12 004 044 937, AFSL 230686) group of companies (“NAB Group”), 105–153 Miller Street, North Sydney 2060. An investment with MLC does not represent a deposit or liability of, and is not guaranteed by, the NAB Group.

The information in this communication may constitute general advice. It has been prepared without taking account of individual objectives, financial situation or needs and because of that you should, before acting on the advice, consider the appropriateness of the advice having regard to your personal objectives, financial situation and needs. MLC believes that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time of compilation. However, no warranty is made as to the accuracy or reliability of this information (which may change without notice). MLC relies on third parties to provide certain information and is not responsible for its accuracy, nor is MLC liable for any loss arising from a person relying on information provided by third parties.

This information is directed and prepared for Australian residents only.

Past performance is not a reliable indicator of future performance.