Brexit, Donald Trump, concerns about China’s economy, bond yields going negative: it’s been unusual and challenging year for investors. As 2016 draws to a close, Portfolio Specialist John Owen reviews what’s happened in investment markets this year and looks ahead to 2017.

2016 was an unusual and challenging year on several fronts for investors. The health of China’s economy and its share market stability were significant concerns at the beginning of the year, though these concerns dissipated as the year progressed. Central banks’ attempts to stimulate growth continued to be a key influence on markets, distorting the prices of many assets. Politics delivered some big surprises.

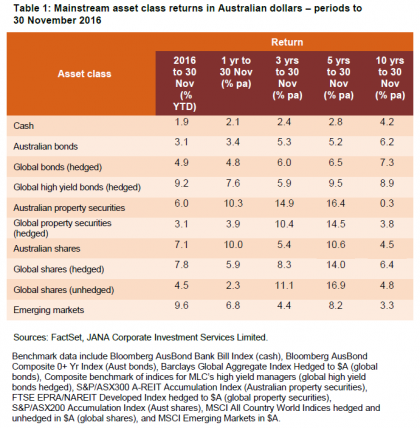

Despite this, investors enjoyed a year of positive, if modest, returns (see Table 1). Medium to long-term investors continued to have pleasing returns, with the major asset classes delivering results in line with or above historical averages.

Britain’s surprising decision to exit the European Union (EU) in June and Donald Trump’s success in the US presidential election in November caused considerable turbulence in financial markets. Global share markets now appear to have taken those events in their stride, retracing lost ground. However, global bond yields have risen sharply in anticipation of significant budget stimulus under a Trump presidency and the US Federal Reserve raising interest rates.

A year of mixed returns on global share markets

Share market returns varied widely this year. There was modest evidence of economic recovery in Europe, but share markets there performed poorly, most likely reflecting heightened anxiety over regional politics. Share markets in Germany and France were down 6.5% and 7.7% respectively in the 12 months to 30 November. Italy’s substantial 25.5% fall reflected the weakness of its economy, concerns about the stability of its banks and, most recently, the potential for more political instability following the Prime Minister’s resignation after the failure of the constitutional referendum.

Japan’s share market continued to be disappointing, with the Nikkei Index falling 7.3% in the 12 months to 30 November as the yen rose and investors began to lose faith in both monetary policy and economic reforms. China’s share market also fell 5.7%, over the period, despite recovering from heavy losses early in the year. By contrast, growth in the US economy helped push the US share market up 5.7%.

Australia’s share market outdid most global peers

Our market delivered a strong return of 10% for the year, outperforming most of the world’s major share markets. This was despite the dampening impact of weak resource prices early in 2016 and low energy prices at the beginning of the year, minimal earnings growth for companies and the underperformance of Australia’s four largest banks (which together account for nearly 30% of share market value). Investors were concerned that the banks’ earnings and dividends momentum would slow.

After their pronounced share price weakness last year, mining companies delivered better returns to investors in 2016. This was due to stronger spot prices late in the year for bulk commodities such as iron ore and coal. A higher gold price also benefitted gold producers.

Elsewhere in our market, returns were broadly positive, though modest compared with the miners. With interest rates at low levels and negative yields on offer from many government bonds, investments providing income security and comparatively attractive distribution yields did well for much of the year. Listed property benefited from the global search for yield, with Australia’s real estate investment trust sector providing a return of 10.3% over the 12 months to 30 November. Utilities and infrastructure stocks also outperformed, although rising bond yields eventually reduced their gains.

A stronger Australian dollar impacted global share returns

Overall, the Australian dollar (AUD) strengthened modestly this year – a change from recent years, when it lost ground against most major currencies.

2016 began poorly for our currency. Concerns that the economic slowdown in China, our largest export market, would be worse than expected forced the AUD down to around 68.6 US cents. Our dollar then rose over the year, partly due to the price recovery of iron ore, our major export commodity. After falling 43% in 2015, the spot price for iron ore rose by 74% in the twelve months to 30 November. As the year progressed, evidence that China’s economy had stabilised benefitted the AUD. Higher yields on Australian bonds, compared with many overseas bonds selling at close to zero or negative yields, helped attract foreign capital and also supported the AUD.

Over the year, the AUD gained 2.2% against the US dollar and 1.9% against the euro. It rose 22.9% against sterling, though this was largely due to sterling’s weakness following the Brexit referendum outcome. The AUD was down 5% against the yen.

For Australian investors, having a hedged global shares strategy (in which the value of the portfolio is protected from a strengthening AUD) was beneficial this year. In the year to 30 November, hedged global shares returned 5.9%, outperforming an unhedged global shares strategy, which returned 2.3%.

Central bank policies remained a key influence on markets

At a time of minimal earnings growth for companies, widespread monetary stimulus helped support share markets again this year.

The US had ended its quantitative easing program in 2014 and begun to raise interest rates late in 2015. During 2016, monetary authorities elsewhere around the world continued to take measures designed to help stimulate economic growth and ward off concerns about deflation. Interest rates in Europe and Japan remained at or near historic lows and their central banks continued to provide much-needed stimulus through a range of actions, including substantial bond purchase programs.

Bonds rallied, with yields continuing to fall as prices rose, resulting in good returns for investors. Falling expectations about inflation and global growth and investors’ preference for ‘safe haven’ investments were factors that drove prices higher and yields lower. World bond yields fell to some of the lowest levels ever during the year. Some government bonds even offered negative yields – a highly unusual situation.

In Australia, the Reserve Bank of Australia reduced the cash rate by 0.25% in each of May and August, sending the rate to a historic low of 1.50%.

However, by year’s end, markets had become increasingly sceptical about how effective central banks’ monetary stimulus policies and very low interest rates were in helping to generate healthy rates of growth and inflation. There is now concern that monetary policy has reached the end of its usefulness, and that there are few options for providing further stimulus other than higher government spending. The measures that policy makers will take in future to promote growth and manage inflation remains a key uncertainty.

Geopolitics was a feature of the year – and there’s more to come

While the UK electorate’s ‘Brexit’ vote to leave the EU was a surprise to markets, this impact was short-lived. Initially there was a negative response, which saw share markets lose ground and a flight to safe haven assets such as gold and developed world bonds. However, markets eventually recovered. In fact, the UK share market was one of the world’s best performers by year’s end, with the FT100 index returning 6.7% in local currency terms over the 12 months to 30 November.

The weakness of the UK pound post-Brexit will benefit many UK companies, particularly those in the healthcare, energy, materials and information technology sectors which make most of their earnings from operations outside the UK.

The election in November of Donald Trump as the next US President was also largely unexpected. The market’s behaviour since the election result suggests that his assertive fiscal program policies, such as spending US$1 trillion on infrastructure, and lower taxes, will be favourable for the economy and American businesses. However, this optimism may prove misplaced: if implemented, his stimulus program could provoke the US Federal Reserve to raise interest rates more aggressively than they did this year and cause a blowout in the US budget deficit.

The Brexit vote and the election of Mr Trump have raised concerns that populist and separatist parties in Europe, many of which are either anti-immigration or against EU membership, could gain power and sponsor a referendum similar to the UK’s on EU membership. Important elections are due in The Netherlands, France and Germany in 2017. Electoral success for these parties, with their narrow, nationalist agendas, would be far more serious for the stability and continuity of the EU and the euro than Brexit.

Despite a more positive end to the year, we remain cautious

Overall, the year ended better for the global economy than it began. In January, China’s economic slowdown looked worse than the market had expected and the outlook for global growth was more uncertain. Adding to market concerns were weakness in commodity markets, especially oil, where prices fell to levels not seen for over a decade, and the risk of deflation in Japan and Europe.

As the year progressed, global economic conditions generally improved at a modest pace, although there are parts of the world (particularly Europe and Japan) where growth was slow. China’s economy picked up during the year due to increased infrastructure spending and an exuberant property market, and the US economy continued to grow.

In Australia, our economy has performed well, despite the substantial contraction in mining-related spending. In the first half of the year, the economy expanded at an annualised rate of 3.2%. However, our economy recorded a rare contraction in the September quarter, with real gross domestic product falling 0.5%, bringing Australia’s annual economic growth rate back to 1.8%.

The outlook for the global economy remains uncertain. There are still numerous risks and uncertainties, which justifies a cautious investment stance and means investors need to have modest return expectations. Public and private debt levels remain high and investment by companies is lower than it should be. Ultra-low interest rates and monetary stimulus have distorted the prices of many assets, the effectiveness of monetary policy seems to be reaching its limits and policy makers have limited firepower to respond to another crisis. Possible electoral success by populist parties in Europe could unsettle the eurozone and the practical implications of a Trump presidency aren’t clear.

A ‘defensive’ portfolio stance is still justified

In the current investment environment, it remains challenging to find asset classes that can offer strong potential returns without unacceptably increasing a portfolio’s risk of negative returns. That’s why we have maintained a defensive portfolio stance for our multi-asset MLC Horizon and Inflation Plus portfolios. We remain concerned that the very loose monetary policy that has been pursued in many parts of the world has been the main driver of markets, rather than economic fundamentals. This has distorted the pricing of many assets, which we consider to be stretched and expensive.

Our defensive position means the portfolios hold more cash than usual. It also means we’ve maintained a high allocation to alternative strategies and to managers we believe are well placed to contribute to preserving investors’ capital and provide potentially better returns for the level of risk we take. In addition, we’ve continued to be very selective about the fixed income we own in our portfolios.

In the MLC Inflation Plus portfolios, we’ve also introduced a defensive Australian shares strategy. The new strategy enables us to increase our exposure to Australian shares – and benefit from the potential returns from this asset class – while carefully controlling the risk of these assets.

How does MLC deal with uncertainty?

At MLC, we focus strongly on risk management. We believe managing risk for our investors is at least as important as generating returns for them – and in this unpredictable investment environment, it’s more critical than ever.

As a result, we design and manage our multi-asset portfolios to be resilient in a wide range of possible market conditions. Using our market-leading investment approach, we constantly assess how our multi-asset portfolios are likely to perform in many potential market scenarios, both good and bad. We can then adjust our portfolios to manage possible risks and take advantage of potential return opportunities.

This careful analysis means our portfolios are widely diversified, risk-aware and positioned for many market environments.

Source: www.mlc.com.au

Important information

This communication is provided by MLC Investments Limited (ABN 30 002 641 661, AFSL 230705) (MLC), a member of the National Australia Bank Limited (ABN 12 004 044 937, AFSL 230 686) (NAB) group of companies (NAB Group), 105–153 Miller Street, North Sydney 2060.

This information may constitute general advice. It has been prepared without taking account of an investor’s objectives, financial situation or needs and because of that an investor should, before acting on the advice, consider the appropriateness of the advice having regard to their personal objectives, financial situation and needs.

You should obtain a Product Disclosure Statement (PDS) relating to the financial products mentioned in this communication issued by MLC Investments Limited, and consider it before making any decision about whether to acquire or continue to hold the product. A copy of the PDS is available upon request by phoning the MLC call centre on 132 652 or on our website at mlc.com.au.

An investment in any product referred to in this communication is not a deposit with or liability of, and is not guaranteed by NAB or any of its subsidiaries.

Past performance is not a reliable indicator of future performance. The value of an investment may rise or fall with the changes in the market. The returns specified in this communication are reported before management fees and taxes.

Any opinions expressed in this communication constitute our judgement at the time of issue and are subject to change. We believe that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time of compilation. However, no warranty is made as to their accuracy or reliability (which may change without notice) or other information contained in this communication.

This information is directed to and prepared for Australian residents only.

MLC may use the services of NAB Group companies where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm’s length basis.

Bloomberg Finance L.P. and its affiliates (collectively, “Bloomberg”) do not approve or endorse any information included in this material and disclaim all liability for any loss or damage of any kind arising out of the use of all or any part of this material.

The funds referred to in this document is not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such fund.